As remote work becomes standard, it is critical for employers to have visibility of where their employees are working. Recent cases show states are becoming more aggressive in auditing out-of-state companies and asserting tax nexus based on employee presence—sometimes for as little as one working day. This table highlights some of the varied withholding tax day count thresholds.

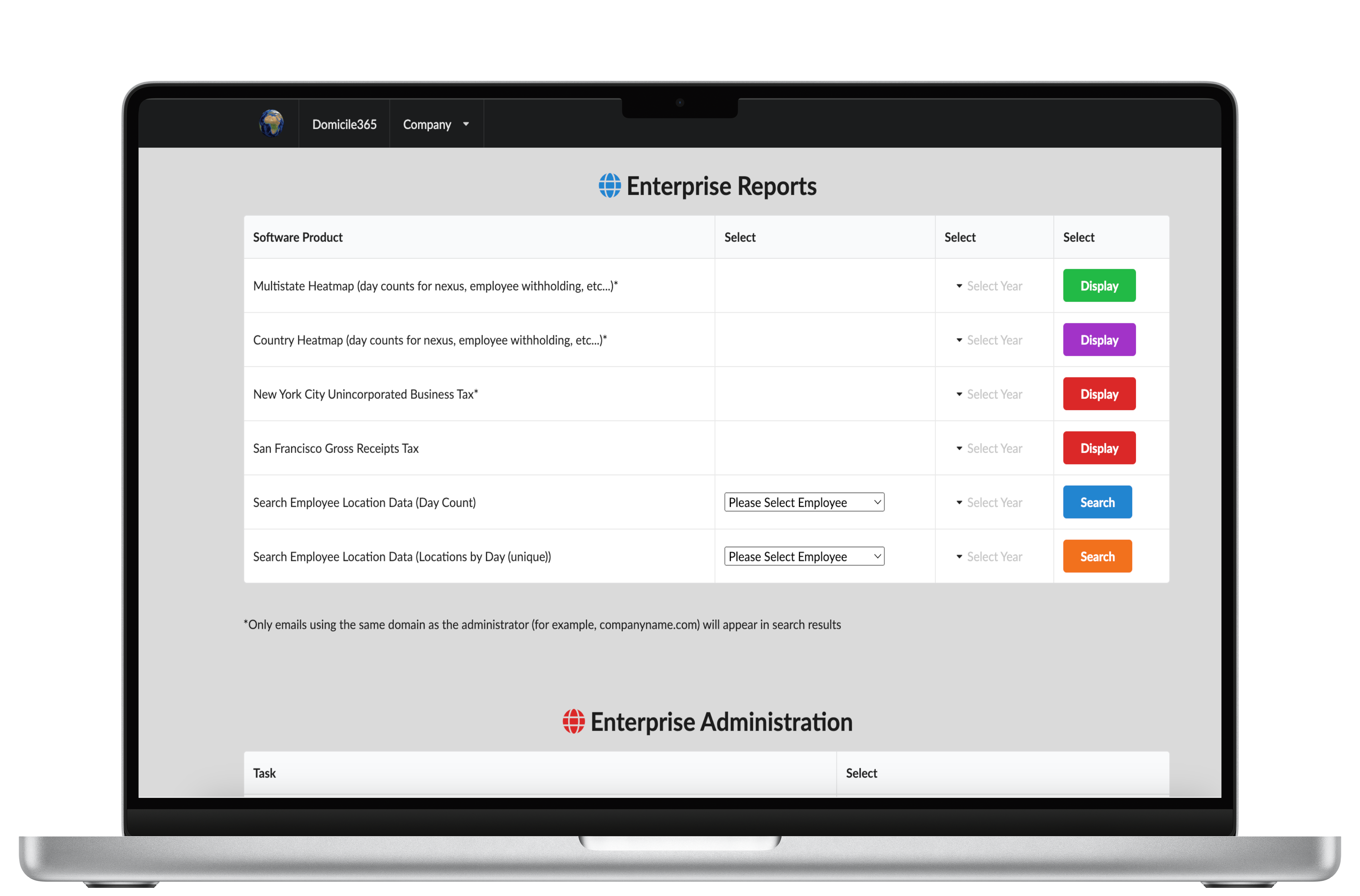

The Domicile365 Application helps companies of all sizes track employee locations to better manage multi-state tax exposures, including payroll withholding, nexus/permanent establishment, BEPs reporting, and specific local taxes like the San Francisco Gross Receipts Tax or NYC Unincorporated Business Tax. Read more in our enterprise brochure.

Each employee downloads the Domicile365 App on their device (iPhone, Android, or macOS). After a one-time setup to grant location permissions, the app works seamlessly in the background. The macOS version is perfect for work computers, running quietly and relying on WiFi for updates, making it a zero-touch solution for many enterprise users.

For information on appropriate or suggested enterprise GPS policies, see our article on Enterprise GPS Permissions.

Invite your employees to install the Domicile365 app on their mobile device or Mac computer.

The app automatically and securely records location data in the background with minimal battery impact.

Access the enterprise dashboard to view heat maps, run reports, and manage compliance.

Sign up for a free trial to see how the Domicile365 Enterprise Platform can help your organization.

Free Enterprise Trial & PricingContact us for a personalized demo or for large organization pricing.

Contact Enterprise Sales (support@domicile365.com)