Residency & Tax Day Count Tracking Software

Learn about the Domicile365 Residency and Tax Day Count Tracking App.

App Key Features

- Download the Domicile365 Residency and Tax Day Count Tracking App at the Apple iTunes App Store. or Google Play Store. Available for iOS, macOS and Android.

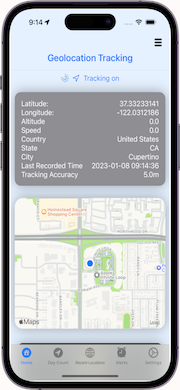

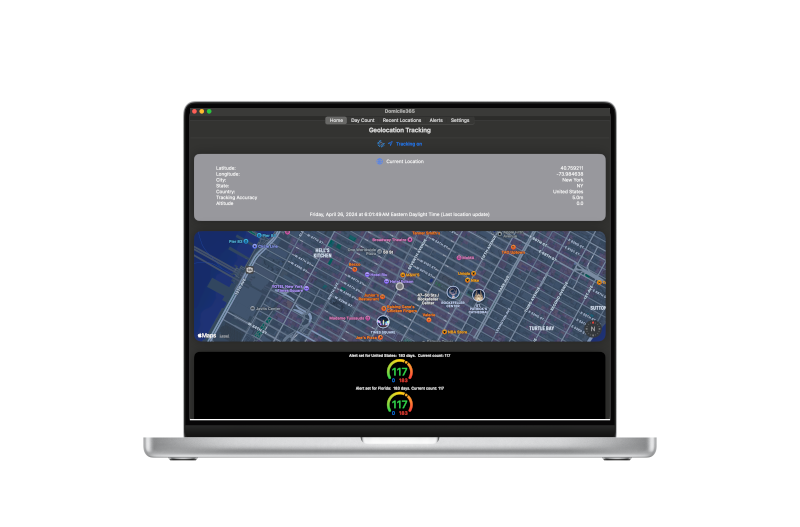

- Track your days spent in various locations for tax, homestead, exemption, statutory residence and other compliance purposes. Track by Country, State, City, Possession, Territory and/or Province. New York City tracking is available.

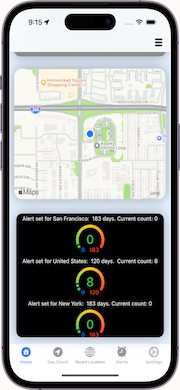

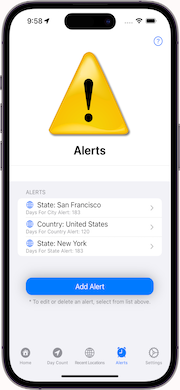

- Set an unlimited number of alerts by Country, State, City, Possession, Territory or Province. Receive alerts by email and local notification on your phone as your reach various day thresholds. Check your alerts at any time.

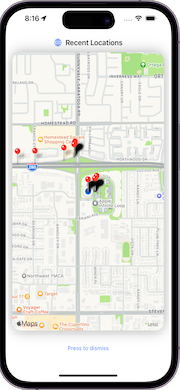

- Location generally recorded in 15 minute increments using the highest level of accuracy supported by your phone. Location is determined using a combination of GPS, Bluetooth, Wi-Fi hotspots and cell tower locations and then recorded. The App's software location algorithms have been refined to minimize battery drain. Learn more about device location tracking in our how Domicile365 records location article and see our guides for Samsung Galaxy and Google Pixel background tracking optimization.

- Calendar feature available to view recorded locations on each day of each month of each year.

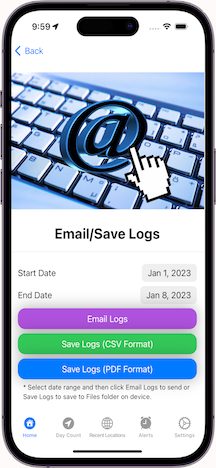

- Search by dates. Email or download detailed logs containing all recorded locations showing your location (Country, State/Possession, City and Province, Time Recorded, Latitude and Longitude) in 15 minute increments.

- Use on device AI Foundation Model to search and analyze location data.

- Manually enter missing dates for time periods before you activated app for more complete analysis.

- Use the Advisor Portal to invite your CPA or financial planner to have "read only" access to your location data.

- Separate Calculators to check (a) U.S. residency day count using special 3 year averaging rule, (b) Puerto Rico presence test under 183 day one-year rule, 549-day 3 year rule, less than 90 days in the U.S. test, more days in Puerto Rico than U.S. test, etc.... and (c) U.K. overnight day count tracking for UK tax residency purposes (and other UK tax residency checks).

- Special day count analysis and counts for jurisdictions that only count presence overnight (e.g., U.K.) or consecutive 24 hour periods (e.g., Maryland, New Mexico, China) as days (as opposed to the standard rule that presence during any part of a calendar day counts as a day). Learn more in our what counts as a day for tax residency article.

- Jurisdictions have become increasingly aggressive in asserting residency status. The burden of proof is generally on you to establish how many days you spent in and outside the jurisdiction. Use this app to help carry your burden of proof and evidence what your day count is. With states and cities increasing their tax rates to all time highs, the stakes have never been higher.

- Detailed day count listings provided by Country, State, City, Possession, Territory and Province. Download or email detailed logs listing each recorded location, with 95-100 daily recorded locations typically available.

- A Schengen or European Travel Information and Authorization System ("ETIAS") visa calculator is included. The Schengen visa calculator tracks your days spent in the Schengen area and calculates the number of days remaining in your 90 day Schengen visa period.

- Tax day count data securely stored in the cloud. Tax day count data will not be used or shared in any manner other than in connection with your use of the App and website. See our Privacy Policy.

- Track tax day counts for employer-employee income tax withholding and non-resident income tax purposes. States impose non-resident income tax and employer income tax withholding based on days worked in-state (ranging from "first day" in state to 30-60 days in a calendar year) notwithstanding that you are not a resident or domiciliary. Enterprise subscriptions and features available for organizations. Learn more about Enterprise Subscriptions.

Download the App from the Apple App Store and Google Play Store. Links are provided at the bottom of this page. Signup for a free 60 day trial either in the App or via our website registration.

Download the user guide (iOS) or user guide (Android) for more details.